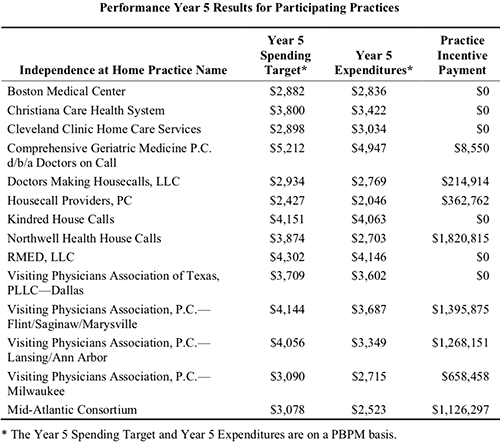

Medicare’s Independence at Home Program Saves Federal Government Millions While Paying Millions to Health Providers That Meet Quality Benchmarks

This CMS pilot program is another opportunity for clinical laboratories to provide medical lab test services and collect specimens outside of traditional sites of healthcare services

Clinical laboratories and anatomic pathology groups are once again reminded to develop strategies that support the increasing number of physicians providing medical care in nontraditional outpatient settings. Now in its seventh year, the Medicare Independence at Home program is reviving the tradition of healthcare providers making house calls to elderly patients who have certain chronic illnesses, and so far, the results are promising.

Primary care teams at the 14 participating healthcare providers include physicians, nurse practitioners, physician assistants, pharmacists, social workers, and other staff.

Hospital networks participating in the federal Centers for Medicare and Medicaid Services (CMS) primary care pilot program are saving the government millions of dollars, while improving healthcare outcomes for their chronically ill patients and earning millions in return.

A CMS fact sheet states that to qualify for incentive payments, participating providers must meet performance thresholds of at least three of the following six measures:

- Follow-up contact within 48 hours of a hospital admission, hospital discharge, and emergency department visit;

- Medication reconciliation in the home within 48 hours of a hospital discharge and emergency department visit;

- Annual documentation of patient preferences;

- Hospital admissions for ambulatory care sensitive conditions; and

- Emergency department visits for ambulatory care sensitive conditions.

Northwell Health House Calls a Model of Success

The Independence at Home (IAH) demonstration project from the federal Center for Medicare and Medicaid Innovation (CMMI) was established in 2010 as part of the Affordable Care Act. In 2018, Congress extended the pilot for another two years and increased the number of eligible participants from 10,000 to 15,000.

Northwell Health House Calls has been a model of success within the federal IAH demonstration project. The New York-based healthcare provider has annually reduced costs while improving health outcomes for participating patients.

Results from the fifth year of the program (Oct. 1, 2016 through Sept. 30, 2017) show Northwell Health reduced per-beneficiary-per-month (PBPM) expenditures to $2,703, compared to a spending target of $3,874, according to the most recent CMS Fact Sheet. In return, Northwell Health received an incentive payment of more than $1.82 million. That’s the largest payout among the eight practices that met incentive payment quality benchmarks and savings requirements.

According to the news release, patients in Northwell’s House Calls program receive comprehensive, coordinated care, that includes ultrasounds, radiology, electrocardiograms, sleep studies, clinical laboratory work, physical exams, occupational and speech therapy, and social services, as well as intravenous fluids and prescription refills.

Physicians, nurse practitioners, and other clinicians are available for urgent, same-day visits during the work week. The team also is accessible 24/7 to answer clinical questions from patients and caregivers, or to arrange urgent services.

In an interview with Crain’s New York Business, Karen Abrashkin, MD, Medical Director of Northwell Health House Calls, said, “We’ve achieved cost savings by providing really good primary care and ongoing care for medical illnesses. We’re responsive to patients whenever they have a change in condition.”

How Patients Qualify for Medicare’s IAH Program

To qualify for the Independence at Home pilot, patients must:

- Currently be Medicare beneficiaries with two or more chronic health conditions;

- Need help with activities of daily living; and

- Have had a hospital admission and rehab stay within the past year.

Though he praises the House Calls program’s success, Kristofer Smith, MD, Senior Vice President of Population Health Management at Northwell Health stated that the program should be expanded slowly and only extended to those who would benefit most from in-home care.

“We need to be thoughtful about making sure we’re not expanding beyond the populations for whom we know it works because [it would] dilute the results,” he told Modern Healthcare.

Will Medicare’s Primary Care at Home Program Continue Beyond the Pilot?

The Independence at Home pilot is scheduled to end Dec. 31, 2020. What happens next is uncertain. Efforts in Congress to create a permanent home-based primary care program under Medicare have not yet gained traction despite bipartisan support.

Thomas Cornwell, MD, CEO, Home Centered Care Institute (HCCI), a national non-profit organization focused on advancing home-based primary care, is skeptical the primary care provider workforce could meet increased demand. He told Home Health Care News that question is “the greatest unknown.”

Nevertheless, the apparent success of Medicare’s Independence at Home pilot program should be a wakeup call to clinical laboratories and anatomic pathology groups that the trend of providing medical services in lower-cost settings will likely continue.

That means medical laboratory leaders should be developing strategies to support providers who are delivering medical care in nontraditional healthcare environments.

—Andrea Downing Peck

Related Information:

Independence at Home Demonstration Performance Year 5 Fact Sheet

Medical House Calls Program Improves Care, Reduces Costs of Treating Elderly Patients at Home

Northwell Wins Big in Medicare Pilot Home-Based Primary Care

Northwell Shows Savings in Medicare Testing House Calls

Elderly and Frail Patients Benefit from Receiving Care in the Comfort of Their Homes

JAMA Study Shows American’s with Primary Care Physicians Receive More High-Value Care, Even as Millennials Reject Traditional Healthcare Settings

Clinical laboratories that help patients access care more quickly could prevent declines in test orders and physician referrals

Millennials are increasingly opting to visit urgent-care centers and walk-in healthcare clinics located in retail establishments. And those choices are changing the healthcare industry, including clinical laboratories and anatomic pathology groups, which traditionally have been aligned with the primary care model.

However, research published in JAMA Internal Medicine suggests outpatients with primary care doctors have better healthcare experiences and receive “significantly more” high-value care. These findings come on the heels of a Kaiser Family Foundation (KFF) Health Tracking Poll which revealed that 26% of 1,200 adults surveyed did not have primary care physicians. And of the millennials polled (ages 18-29), nearly half (45%) had no primary care provider.

Why is this important? High-value care include many diagnostic and preventative screenings that involve clinical laboratory testing, such as colorectal and mammography cancer screenings, diabetes, and genetic counseling.

And, as Dark Daily reported in “Millennials Forge New Paths to Healthcare, Providing Opportunities for Clinical Laboratories,” the increasing popularity of retail-based walk-in clinics and urgent-care centers among millennials means traditional primary care is not meeting their needs. That’s in large part because of time.

And, this is where clinical laboratories can help.

In the Millennial’s World, Convenience Is King

Millennials are Americans born between the early 1980s to late 1990s (AKA, Gen Y). And, as Dark Daily reported, they value convenience, saving money, and connectivity. Things they reportedly do not associate with traditional primary care physicians.

According to the KFF poll:

- 45% of 18 to 29-year-olds,

- 28% of 30 to 49-year-olds,

- 18% of 50 to 64-year-olds, and

- 12% of those age 65 and older, have no relationship with a primary care provider.

Thus, it’s not just millennials who are not seeing primary care doctors. They are just the largest age group.

When this many people skip visits to primary care doctors, medical laboratories may see a marked decline in test volume. Furthermore, shifting consumer preferences and priorities means clinical laboratories need to reach out and serve all healthcare consumers, not just millennials, in new and creative ways.

Consider Changes in Lab Business Model

Dark Daily advises clinical laboratory leaders to consider changes in how they do business to better serve busy consumers. Here are a few ways to appeal to people of all ages who seek value, fast service, and connectivity:

- Offer walk-in testing with no appointments.

- Create easy-to-navigate online scheduling tools.

- Enable patients to request tests without doctors’ orders as the lab’s market allows.

- Make results quickly available and in easy-to-understand reports.

- Post test results online for patients to securely access in patient portals.

- Make it easy to interact with personnel or receive information through lab websites.

- Collaborate with telehealth providers.

- Post prices of the most commonly ordered tests.

- Use social media to promote the lab and respond to online reviews.

Younger Americans Do Not Perceive Value of Primary Care

The JAMA researchers studied 49,286 adults with primary care and 21,133 adults without primary care between 2012 and 2014. The methodology entailed:

- 39 clinical quality measures,

- Seven patient experience measures, and

- 10 clinical quality composites (six high-value and four low-value services).

“Americans with primary care received significantly more high-value care, received slightly more low-value care, and reported significantly better healthcare access and experience,” the JAMA authors wrote.

Healthcare Dive notes that the JAMA study may be the first time researchers have substantiated the higher value of primary care, which generally provides services for:

- Cancer screening (colorectal and mammography),

- Diagnostic and preventive testing,

- Diabetes care, and

- Counseling.

“Poor primary care supply or access may be hurdles, or some Americans do not perceive the potential value of primary care, particularly if they are younger … and healthier,” the JAMA researchers noted.

An earlier study published in JAMA Internal Medicine titled, “Comparison of Antibiotic Prescribing in Retail Clinics, Urgent Care Centers, Emergency Departments, and Traditional Ambulatory Care Settings in the United States,” suggests that prescriptions for antibiotics written to patients that visit non-traditional healthcare settings are increasing.

The study found that “Only 60% of outpatient antibiotic prescriptions dispensed in the United States are written in traditional ambulatory care settings [defined as medical offices and emergency departments]. Growing markets, including urgent care centers and retail clinics, may contribute to the remaining 40%.”

A Washington Post analysis of this JAMA study reports that “nearly half of patients who sought treatment at an urgent-care clinic for a cold, the flu, or a similar respiratory ailment left with an unnecessary and potentially harmful prescription for antibiotics, compared with 17% of those seen in a doctor’s office.”

This drives home the importance of having a primary care doctor.

“Antibiotics are useless against viruses and may expose patients to severe side effects with just a single dose,” notes Kevin Fleming, Chief Executive Officer of Loyale Healthcare, a healthcare financial technology company, in its analysis of the earlier JAMA study. “Care that’s delivered on a per-event basis by an array of unrelated providers can’t match the continuity of care that is achievable when a patient receives holistic care within the context of a longer-term physician relationship,” he concluded.

Clinical laboratory leaders and pathologists are advised to regularly engage with primary care physicians—not just oncologists and other specialists—and keep them informed on what the lab is doing to better attract millennials and develop long-term relationships with them based on their values.

—Donna Marie Pocius

Related Information:

For Millennials, a Regular Visit to the Doctor’s Office is not a Primary Concern

JAMA Study Makes Case for Investing in Primary Care

Millennial Expectations Fundamentally Changing Healthcare Landscape

Millennials Forge New Paths to Healthcare, Providing Opportunities for Clinical Laboratories –

Webinar | Using Lab 2.0 to Combat Opioid-use Disorder: Lessons Learned and What Comes Next in Improving Patient Outcomes and Cost of Care

Using Lab 2.0 to Combat Opioid-use Disorder: Lessons Learned and What Comes Next in Improving Patient Outcomes and Cost of Care Dark Daily Webinar – Wednesday, June 12 at 1 PM EDT Order DVD Now Opioid overuse and addiction continue to contribute significantly to health issues of the nation’s population and to the increased cost of healthcare, making it even more vital for providers to optimally prescribe for and monitor, in the safest manner, their patients using opioid drugs. The role of...New AHA Report Finds Hospital Outpatient Revenue Nearing Inpatient Revenue, While CMS Proposes Paying Less for In-hospital Healthcare Services

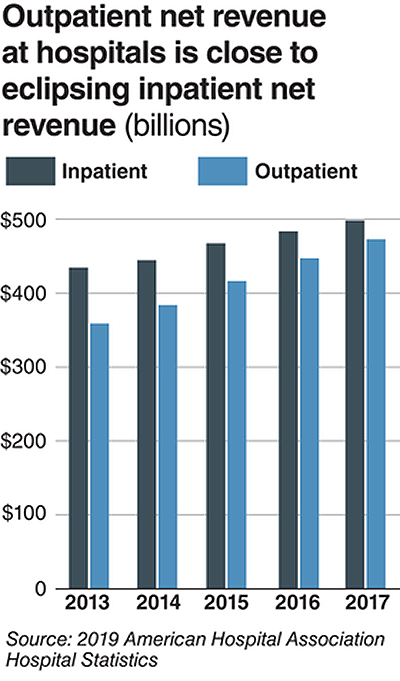

Clinical laboratories that service both settings could be impacted as new CMS proposed rule attempts to align Medicare’s payment policies for outpatient and in-patient settingsHospital outpatient revenue is catching up to inpatient revenue, according to data released from the American Hospital Association (AHA). This increase is part of a growing trend to reduce healthcare costs by treating patients outside of hospital settings. It’s a trend that is supported by the White House and Medicare and continues to impact clinical laboratories, which serve both hospital inpatient and outpatient customers.

The AHA published this study data in its annual Hospital Statistics, 2019 Edition. The data comes from a 2017 survey of 5,262 US hospitals. The report includes data about utilization, revenue, expenses, and other indicators for 2017, as well as historical data.

The AHA statistics on outpatient revenue suggest providers nationwide are working to keep people out of more expensive hospital settings. Hospitals, like medical laboratories, appear to be succeeding at developing outpatient and outreach services that generate needed operating revenue.

This aligns with Medicare’s push to make healthcare more accessible through outpatient settings, such as urgent care clinics and physician’s offices. A growing trend Dark Daily has covered extensively.

Outpatient Revenue Climbs

In its coverage of the AHA’s study, Modern Healthcare reported that 2017 hospital net inpatient revenue was $498 billion and net outpatient revenue was $472 billion.

The Becker’s Hospital CFO Report notes that gross inpatient revenue in 2017 was $92.7 billion higher than gross outpatient revenue. But in 2016, gross inpatient revenue was much further ahead—$129.5 billion more than gross outpatient revenue. The “divide” between inpatient and outpatient revenue is narrowing, Becker’s reports.

The graphic above illustrates the shrinking gap between hospital inpatient and outpatient revenues. “Outpatient revenue will ultimately eclipse inpatient revenue,” Chuck Alsdurf, Director of Healthcare Finance Policy and Operational Initiatives at the Healthcare Financial Management Association (HFMA), told Modern Healthcare. (Graphic copyright: Modern Healthcare/AHA.)

The Becker’s report also stated:

- Admissions increased by less than 1% to 34.3 million in 2017, up from 34 million in 2016;

- Inpatient days were flat at 186.2 million;

- Outpatient visits rose by 1.2% to 766 million in 2017; and,

- Outpatient revenue increased 5.7% between 2016 and 2017.

Similar Study Offers Additional Insight into 2018 Outpatient Revenue

A benchmarking report by Crowe, a public accounting, consulting, and technology firm, which analyzed data from 622 hospitals for the period January through September of 2017 and 2018, showed the following, as reported by RevCycleIntelligence:

- Inpatient volume was up 0.6% in 2018 and gross revenue per case grew by 5.3%;

- Outpatient services rose 2.4% in 2018 and gross revenue per case was up 7.1%.

Physicians’ Offices Have Lower Prices for Some Hospital Outpatient Services

Everything, however, is relative. When certain healthcare services traditionally rendered in physician’s offices are rendered, instead, in hospital outpatient settings, the numbers tell a different story.

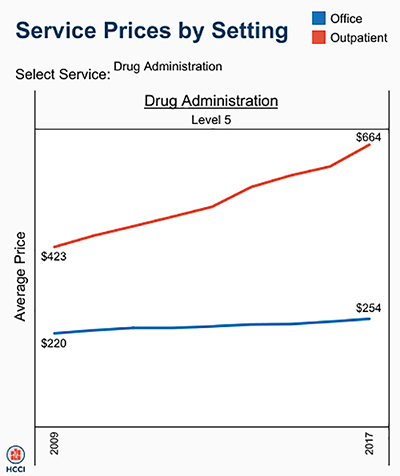

In fact, according to the Health Care Cost Institute (HCCI), the price for services was “always higher” when performed in an outpatient setting, as compared to doctor’s offices.

HCCI analyzed services at outpatient facilities as well as those appropriate to freestanding physician offices. They found the following differences in 2017 prices:

- Diagnostic and screening ultrasound: $241 in physician’s office—$650 in hospital outpatient setting;

- Level 5 drug administration: $254 in office—$664 in hospital outpatient setting;

- Upper airway endoscopy: $527 in office—$2,679 in hospital outpatient setting.

One example where hospital outpatient settings provide similar services at increased costs is in drug administration, as the graphic above illustrates. “The difference was higher than I expected. With some services, the price is two or three times higher when rendered in the outpatient setting,” Julie Reiff, HCCI researcher and report author, told Fierce Healthcare. (Graphic copyright: HCCI.)

Medicare Proposed Rule Would Change How Hospital Outpatient Clinics Get Paid

Meanwhile, the Centers for Medicare and Medicaid Services (CMS) has released its final rule (CMS-1695-FC), which make changes to Medicare’s hospital outpatient prospective payment and ambulatory surgical center payment systems and quality reporting programs.

In a news release, CMS stated that it “is moving toward site neutral payments for clinic visits (which are essentially check-ups with a clinician). Clinic visits are the most common service billed under the OPPS [Medicare’s Hospital Outpatient Prospective Payment System). Currently, CMS often pays more for the same type of clinic visit in the hospital outpatient setting than in the physician office setting.”

“CMS is also proposing to close a potential loophole through which providers are billing patients more for visits in hospital outpatient departments when they create new service lines,” the news release states.

Hospitals are fighting the policy change through a lawsuit, Fierce Healthcare reported.

In summary, clinical laboratories based in hospitals and health systems are in the outpatient as well as inpatient business. Medical laboratory tests contribute to growth in outpatient revenue, and physician offices compete with clinical laboratories for some outpatient tests and procedures. Thus, a new site-neutral CMS payment policy could affect the payments hospitals receive for clinic visits by Medicare patients.

—Donna Marie Pocius

Related Information:

AHA Data Show Hospitals’ Outpatient Revenue Nearing Inpatient

Hospitals’ Outpatient Revenue Inching Closer to Inpatient Revenue

“My Net Revenue is Stable,” said No CFO Ever . . .

Revenue Unable Despite Outpatient Volume Growth

From Physician Offices to Outpatient Settings and Costs Go Up, HCCI Study Finds

CMS Empowers Patients and Ensures Site Neutral Payment Proposed Rule –