Minnesota Hospitals in Financial Crisis as State’s Healthcare Systems Record Hundreds of Millions of Dollars in Losses

Nationwide, hospital losses are in the billions of dollars, which affects access to medical care including clinical laboratory testing

Hospitals and health systems across the United States continue to report substantial financial losses. At some institutions, this might severely restrict access to physicians and clinical laboratory testing for patients in those areas. The latest state to announce its hospitals were in trouble is Minnesota. The Minnesota Hospital Association (MHA) announced its hospitals are in “financial crisis” revealing that the state’s health systems experience hundreds of millions of dollars in operating losses annually.

The MHA stated that two out of three surveyed hospitals in Minnesota reported losing money in the cumulative amount of more than $400 million during the first half of 2023, KARE 11 reported. The MHA surveyed more than 70 health system members which represented facilities of all sizes and in all geographical regions of the state.

Rahul Koranne, MD, President and CEO of MHA told KARE 11 that part of the problem is that a larger proportion of patients rely on federal programs such as Medicare and Medicaid to pay hospital costs. Those programs provide lower reimbursement rates when compared to private insurers. In some facilities, almost 75% of patients are on one of these government programs.

“Those reimbursements, or payments, are fixed. So, we can’t raise prices. These two programs are paying significantly below the cost of providing care to our patients,” he noted. “So, if you have 70% of your patients covered by these governmental programs, we can’t raise prices, and they’re paying you below the cost of care—that’s what causes [the problem].”

He went on to state that workforce staffing represents a significant challenge for hospitals and urged the state legislature to address the needs of health professionals and facilities.

“We need to really resource it in this upcoming session and many sessions to come, so that we can have workers and staff we need,” Koranne said. “If we don’t have the money, and if we don’t have the workers, we will not be providing care and that would be sad.”

“This is a pretty grave state and, I would say, quite a crisis,” Rahul Koranne, MD (above), President and CEO of the Minnesota Hospital Association, told KARE 11. “Our not-for-profit hospitals and healthcare systems are hanging dangerously from this cliff and they’re getting tired.” Access to medical laboratory testing can be greatly affected by hospital financial losses. (Photo copyright: Twin Cities Business.)

Other US Healthcare Systems in Crisis as Well

Minnesota is not the only state with healthcare systems in financial crisis. Last year, the Washington State Hospital Association (WSHA) announced that hospitals in that state reported cumulative losses of $2 billion for 2022. Cassie Sauer, President and CEO of WSHA told the media that the massive deficits are “clear and incredibly concerning” to the state’s healthcare leaders.

In “Hospitals, Pharmacies Struggle to Be Profitable,” we reported that the WSHA survey determined that the state’s hospitals suffered collective operating losses of $750 million during the first six months of 2023.

“The financial losses that our hospitals are experiencing continue to be enormous,” Sauer told The Seattle Times. “Revenues simply are not keeping up with rapidly escalating costs. It’s most concerning as these large losses are putting patient care at risk in many communities across the state.”

The WSHA findings were based on a survey of 81 acute-care hospitals that represented about 98% of the state’s hospital beds. Of those facilities, 69 reported losing money mostly due to rising costs for supplies, labor, and other expenses as well as the need for longer hospital stays due to more complicated care and a larger percentage of patients on government programs, which offer lower reimbursement rates for care.

“When hospitals are not financially viable and over time sustain heavy losses, you must either increase revenue or reduce healthcare services,” Chelene Whiteaker, Senior Vice President, Government Affairs at WSHA, told The Seattle Times. “Reducing healthcare services is an option nobody wants on the table. So, that leaves increasing revenues.”

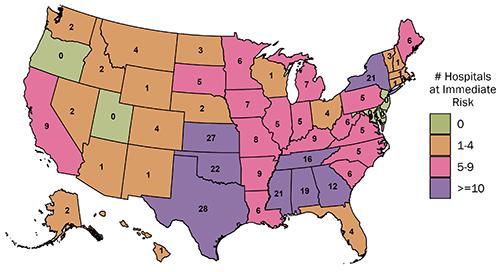

The graphic above from the Center for Healthcare Quality and Payment Reform (CHQPR) shows the number and location of rural hospitals in America that are at “immediate” risk of closure. The number of hospitals simply “at risk” of closure is substantially higher. Patients who depend on these hospitals would lose access to critical healthcare services including clinical laboratory testing. (Graphic copyright: Center for Healthcare Quality and Payment Reform.)

Becker’s Hospital Review reported last year that many hospitals across the country reported substantial losses in 2022. Three of the hospital systems in that article reported losses in the billions. They were:

- Kaiser Permanente (net loss of $4.5 billion),

- Mass General Brigham (net loss of $2.3 billion), and

- Cleveland Clinic (net loss of $1.2 billion).

In addition, Becker’s noted that five healthcare systems reported encountering losses over half a billion dollars in 2022. They include:

- University of Pittsburgh Medical Center (net loss of $916 million),

- AdventHealth (net loss of $837.9 million),

- Indiana University Health (net loss of $715 million),

- Fairview Health Services (overall loss of $562.9 million), and

- MultiCare Health System (overall loss of $515 million).

Critical Services Are Being Cut

In another article, Becker’s reported that 72 hospitals across the US closed departments or ended services in 2023. These cuts included the shuttering of health and urgent care clinics, the closure of outpatient cancer and pulmonary clinics, the reduction of certain surgical services and behavioral health services, and the ending of home healthcare services.

Some states are taking measures to prevent further hospital closures. But is it too late? In “California Doles Out $300 Million in No-Interest Loans to Save its Financially Struggling Hospitals,” The Dark Report’s sister publication Dark Daily covered how that state had launched an interest-free loan program to ensure local communities have access to community hospitals, their physicians, and clinical laboratories. No report on how many hospitals have been temporarily saved from closing thanks to this program.

If US hospitals continue to lose money at this rate, access to critical care—including clinical laboratory and anatomic pathology services—could be further restricted and facilities closed. These actions may also result in increased staff layoffs and have an even greater effect on patient care in Minnesota, Washington State, and throughout the US.

—JP Schlingman

Related Information:

Minnesota Hospital Association CEO Says the State’s Hospitals are in a Financial ‘Crisis’

A Hard Look at Minnesota Hospital Finances

WA Hospitals Lost $2 Billion in 2022. A Plan to Up Medicaid Rates Could Help

72 Hospitals Closing Departments or Ending Services

What’s Up with Hospital Finances?

What’s Behind Losses at Large Nonprofit Health Systems?

20 Health Systems Reporting Losses in 2022

CHQPR Report: Rural Hospitals at Risk Of Closing

More Than 30% of Rural Hospitals Are at Risk of Closure, Report Warns

California Doles Out $300 Million in No-Interest Loans to Save its Financially Struggling