As inpatient care declines, outpatient care expands, signaling a shift from where physician orders for medical laboratory tests originate

It’s a well-established fact that the year-over-year increase in the volume of outpatient procedures is consistently greater than 8%, while the annual growth in inpatient admissions is at or below 3%. Clinical laboratory managers and anatomic pathologists are aware of these facts.

MEDACorp, a strategic knowledge resource and subsidiary of Leerink Partners, a Boston-based investment bank that focuses on the healthcare industry, conducted a quarterly survey of hospital administrators from 47 hospitals in June of this year. The purpose was to evaluate healthcare utilization trends for different types of medical facilities.

According to the survey, the “ utilization trends for both [quarter-over-quarter] and [year-over-year] are decelerating across all four sites of service.” However, hospital administrators report the use of inpatient and other hospital services did not fare as well.

“The results are also modestly positive for facilities, with the slowing 0.7% increase in inpatient procedures (IP) utilization still higher than consensus of ~flat (sic) for the coverage group. Significant mix shift continues as IP mix is down and the outpatient procedure (OP) mix is up across all service lines, supporting our recent analyses of an accelerated push to ambulatory sites of service,” the survey noted.

The survey revealed:

- Inpatient services increased by just 0.7% during the second quarter of 2018, down from 1% growth during the second quarter of 2017;

- Ambulatory surgery center utilization grew by just 1.4% during the second quarter of 2018, down from 2.2% for the same quarter in 2017; and,

- Emergency department utilization increased by 0.9% in the second quarter of 2018.

“It was even weaker than many of us expected,” Ana Gupte, PhD, Managing Director, Healthcare Services at Leerink, told Modern Healthcare. “It’s pretty clear there’s no volume rebound.” (Photo copyright: Leerink.)

Inpatient Top Surgeries Predicted to Keep Moving to Outpatient Settings

The Leerink survey found that orthopedic and cardiac procedures are leading the trend of shifting clinical procedures from inpatient to outpatient care. For example, heart surgeries were performed in outpatient settings 9% of the time over the past year and are expected to increase to 12% during the next year. Inpatient heart surgeries are expected to decrease 1% over the next year, moving from 82% to 81% of surgeries performed.

Inpatient hip procedures also are projected to drop from 77% to 75% over the course of the next year, while outpatient hip procedures are expected to increase from 17% to 19%. The survey respondents also expect other surgeries including urological, gynecological, spine and knee procedures to move to outpatient settings over the next year.

Forty-five percent of the respondents in the survey named baby boomers aging into Medicare as the most important driver of hospital utilization. Fifteen percent attributed the trend to the effects of the Affordable Care Act (ACA), and 13% cited the improving US economy as driving the use of outpatient medical facilities.

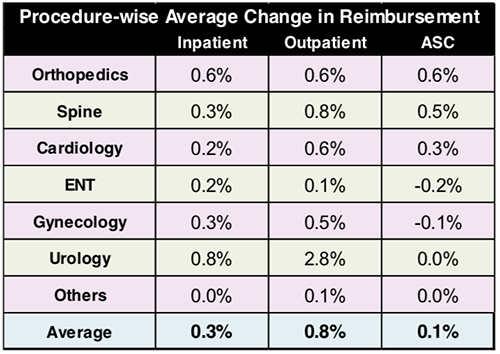

The graphic above, taken from the Leerink MEDACorp survey, illustrates a shift in healthcare procedures from inpatient to outpatient settings. Along with the surgical relocations are changes in reimbursements as well, which directly impacts clinical laboratories revenue streams and billing procedures. (Image copyright: Leerink.)

The survey respondents were from different regions and disparate population areas:

- 49% of the surveyed facilities were located in metropolitan areas;

- 40% were in suburban areas; and,

- 11% were in rural areas.

In addition:

- 32% were in the South;

- 26% were in the Northeast;

- 21% were in the Midwest; and,

- 21% were in the West.

Most of the facilities used in the survey were community hospitals, which accounted for 62% of the environments. Thirty-two percent of the facilities were academic medical centers, while the remaining 6% were other types of facilities.

The majority of the respondents for the survey were C-suite executives. In hospital settings that would include the Chief Executive Officer (CEO), Chief Financial Officer (CFO), Chief Operating Officer (COO), and other Chief titles, and, of course, hospital administrators.

Clearly, this type of downward trend could negatively impact clinical laboratories, pathology groups, and other service lines in hospital networks. Fewer patients equal less revenue for hospitals, which could eventually lead to budget cuts. A responsible medical laboratory manager will be prepared for these possibilities.

—JP Schlingman

Related Information:

Hospital Execs Say Inpatient Volume Growth Isn’t Rebounding

Hospital Utilization Slows as Healthcare Moves to Cheaper Care Settings

2Q18 Hospital Util. Survey: Utilization Decelerating, Shift To OP/ ASC Continues

ASCs Beat Inpatient Setting for Quarter, Year-over-year Utilization Increases—6 Study Insights

10 Key Trends for ASCs and Outpatient Surgery in the Next 10 Years