Poor rates of growth in hospital revenue and admissions is not good news for clinical laboratories

During 2010, not-for-profit hospitals showed the lowest rate of growth in at least two decades, according to a report released by Moody’s Investors Service, a holding of Moody’s Corporation (NYSE: MCO). This may be an early sign that hospital laboratories will soon be asked to work with leaner budgets during the coming year.

In its report, dated August 10, 2011, financial analysts at Moody’s predicted a mean growth rate of 4% in revenue for not-for-profit hospitals. There are multiple and complex factors contributing to the drop in mean revenue growth of not-for-profit hospitals. The report authors wrote that:

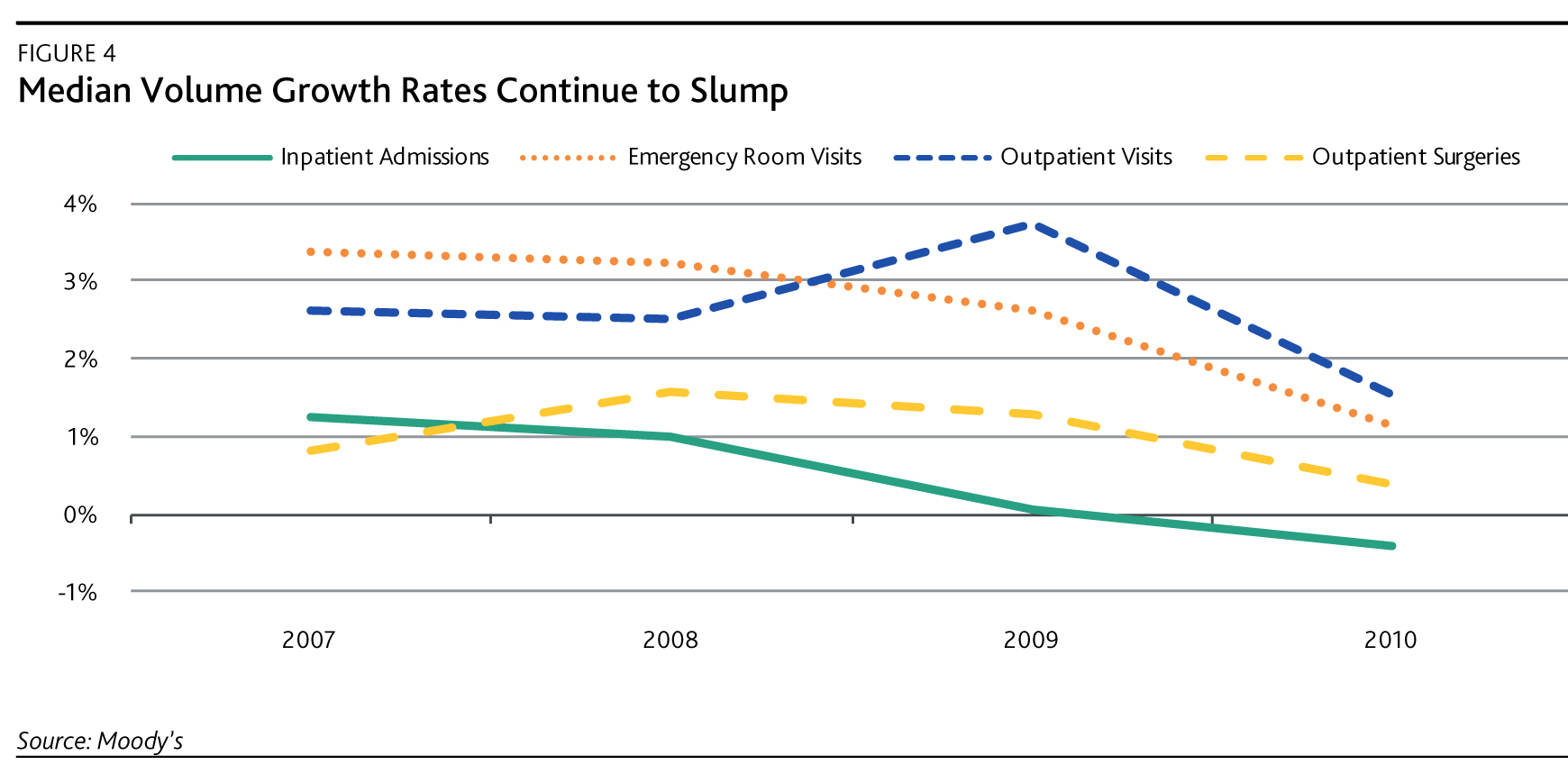

- For any business, revenue growth is comprised of two variables: rates (or price) and volumes. Inpatient admission volumes for not-for-profit hospitals continue to decline (see figure 4) with the growth rate actually turning negative in FY 2010. Reasons for the decline include a patient’s decision to defer elective medical procedures due to the weakened economy; higher co-pays and deductibles required by employers who still offer health insurance or are discontinuing employer-provided healthcare coverage; a less-intense flu season and a lower national birth rate.

Financial Trends in the Hospital Industry Do Affect Clinical Laboratories

Moody’s negative assessment of the not-for-profit hospital sector is the latest in a series of unfavorable financial reports. In its preliminary review of 2007 median ratios for not-for-profit hospitals, Moody’s commented on its lack of enthusiasm for the sector, which it attributed to sluggish volume and disappointing revenue growth during that reporting period. The current data indicate a steady decline in revenues since about mid-2005, with the exception of slight increases between mid-2007 to mid-2008.

This chart from Moody’s Investor Services shows the median volume growth rates for several hospital business lines, in %, for not-for-profit hospitals over the past 20 years. Moody’s analysts noted that, for 2010, this measure was the lowest over the past 20 years that they have collected this data. (Graph © Moody’s Investor Services.)

The Moody’s analysts also pointed out that the current plight of commercial payers means less money will flow to hospitals. That is because private health insurers are themselves dealing with declining membership and increased regulation. Both factors negatively impact rate increases for inpatient hospital services and upward adjustments to the prices paid for hospital services.

There is some positive news. According to the recent Moody’s report, the company saw evidence of some stabilization of revenue growth after reviewing a small sample of unaudited interim FY 2011 statements. The data suggest that hospital boards and management teams during the past year did a good job responding to the challenge, improving performance with quality initiatives and reining in expenses. Finally, greater coverage under healthcare reform may decrease uncompensated care in the long term.

“Many hospitals have achieved operating performance stability thanks to good expense controls and capable management,” wrote Brad Spielman, Moody’s Vice President and Senior Analyst. He made these comments in the Moody’s report from February of this year. “Implementation of provider fees in many states has also helped to create short-term relief from Medicaid reimbursement pressures, the rebound in investment markets, and the preponderance of strong liquidity among healthcare systems.”

Short-term Challenges to Hospitals as Mergers and Acquisitions Increase

One result of the tough times is an increase in the number of hospital mergers, according to an article in The Wall Street Journal. “It’s a way to get to the next level of economies of scale,” declared Ralph de la Torre, who is Chief Executive of Steward Health Care System LLC. Citing numbers from Irving Levin Associates in Norwalk, Connecticut, The Wall Street Journal story noted that 55 hospital mergers were transacted in the first six months of this year, compared to 26 hospital mergers seen at the halfway point of last year.

It is important for pathologists and clinical lab managers to understand this trend, as weak financial performance by the parent hospital/health system often causes hospital administrators to prune back the budgets for clinical services, including the clinical laboratory and pathology. It is noteworthy that 63% of the hospitals studied by Moody’s had “thin profit margins.” Moody’s defined thin profit margins as break-even to 5%.

How should clinical laboratory managers and pathologists respond to these findings? First, with financial analysts at Moody’s declaring that revenue growth at the nation’s not-for-profit hospitals is the lowest in 20 years, it may be that hospital administrators will take proactive steps to further squeeze down the budgets for clinical services in the next budget cycle. Second, with commercial health plans experiencing their own financial challenges, it is not likely that significant price increases for medical laboratory tests are in the cards for 2012.

–Pamela Scherer McLeod

Related Information

Moody’s negative outlook continues for not-for-profit healthcare in 2011

Moody’s shows little enthusiasm for non-profit hospital finances