In both the hospital market and the ambulatory market, Epic has the best-selling electronic health records system, according to data issued by ONCHIT

Across the nation, clinical laboratories and pathology groups are busy interfacing their laboratory information (LIS) systems to the electronic health record (EHR) systems of their client hospitals and physicians. Yet, few lab managers know which EHR systems are dominating the market and which EHR systems are barely surviving.

In fact, it can be a challenge to understand market share by vendor. That is because market share can be determined in multiple ways. Dark Daily found three different rankings of EHR vendors. Each was based on slightly different sets of data.

Beckers Says that 10 EHR Vendors Control 90% of the Hospital Market

In its analysis, Beckers Hospital Review determined that the concentration of market share is at the point where just 10 EHR vendors now control 90% of hospital market share. This appeared in a recent report. These companies were identified based on meaningful use attestation data from the Centers for Medicare and Medicaid (CMS).

Beckers Hospital Review identified the top ten EHR products as follows:

• Meditech (NASDAQ:MEDT),

• Computer Programs & Systems, Inc. (NASDAQ:CPSI),

• Cerner (NASDAQ:CERN),

• McKesson (NYSE: MCK),

• Healthland,

• Siemens (OTC: SMAWF),

• Healthcare Management Systems,

• Allscripts (NASDAQ:MDRX), and,

Fast Growth in Eligible Professinals Attesting to Meaningful Use

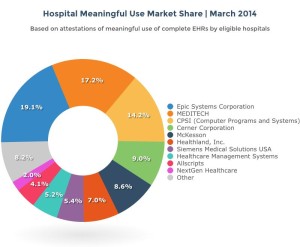

Above is a diagram of electronic medical records vendors’ hospital market share provided by Software Advice, a company based in Austin, Texas. This chart is based on the number of attestations of meaningful use of complete EHRs by eligible hospitals. It determined that 10 EHR vendors control more than 90% of the hospital EHR market. (Graphic copyright Software Advice.)

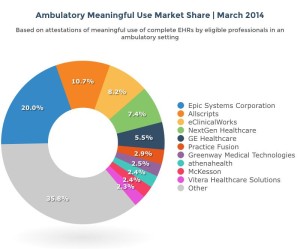

In its assessment of the ambulatory sector, Software Advice observed that a surprising amount of fragmentation exists in this sector. Each of the five top vendors have a market share that is less than 3%. Meanwhile, about 35% of the ambulatory EHR market remains in the hands of other smaller vendors. The company further noted that “Just as the market leaders are holding steady, smaller [EHR] vendors are clearly maintaining their footholds and didn’t concede any ground in 2013 (compared with 2012, when “other” vendors claimed a 35.3 percent share of the market).”

This diagram above shows the market share of ambulatory EHR systems by vendor. It was compiled by Software Advice, a company based in Austin, Texas. This chart is based on the number of attestations of meaningful use of complete EHRs by eligible professionals in an ambulatory setting. Compared to market share in the hospital sector, there is much less concentration of market share in the ambulatory market, as the top ten EHR vendors only control 64.7% of the this sector. (Graphic copyright Software Advice.)

Software further wrote: “What’s surprising is how fragmented the market continues to be: five of the market’s top 10 vendors boast a market share of less than 3% each, and nearly 40% of the market uses an EHR from a vendor that falls outside of the top 10. Just as the market leaders are holding steady, smaller vendors are clearly maintaining their footholds and didn’t concede any ground in 2013 (compared with 2012, when “other” vendors claimed a 35.3% share of the market).”

Medical Laboratories Must Interface Their LIS to Doctors’ EHRs

Of interest to medical laboratories that must spend time and money to interface their LISs to the EHRs of office-based physicians, the EHR replacement market is growing. On this point, Software Advice said, “In 2013 we reported that, among the EHR buyers Software Advice talks to on a daily basis, the percentage replacing existing software has nearly doubled since 2010, while the percentage purchasing software for the first time has declined. In other words, EHR replacements are on the rise, indicating a fair amount of dissatisfaction among consumers. This has doubtlessly contributed to the ever-growing number of vendors entering the market.”

This is not auspicious for clinical labs and pathology groups. Each time a physician’s office decides to scrap its existing EHR system and implement another vendor’s EHR, the lab will have to again spend money to interface their LIS to this new EHR. That becomes an expensive proposition for labs that serve hundreds and thousands of physicians’ offices.

Top 15 EHR Vendors:

(Ranked by number of providers where organization is the primary vendor.)

Vendor — Number of providers where vendor is primary

1. Epic Systems Corp. – Verona, Wis. 79,031

2. Allscripts – Chicago 45,653

3. eClinicalWorks – Westborough, Ma 35,280

4. NextGen Healthcare – Horsham, Pa. 34,430

5. GE Healthcare – Wauwasa, Wis. 27,112

6. Cerner Corp. – N Kansas City, Mo. 14,442

7. Practice Fusion – San Francisco 10,971

8. Vitera Healthcare Solutions – Tampa, Fla. 10,063

9. PrimeSuite – Carrollton, Ga. 9,008

10. McKesson Corp. – San Francisco 8,830

11. Athenahealth (NASDAQ: ATHN) – Watertown, Mass. 7,448

12. e-MDs – Austin, Texas 5,777

13. Mendent – Auburn, N.Y. 4,175

14. Eyefinity – Rancho Cordova, Ca 4,043

_____________________________________________________

Note:

1) Each vendor has EHR products used in a provider’s EHR that meets the majority of meaningful-use requirements

2) Each vendor is the sole vendor of EHR products for the provider; alternatively and is a vendor of a complete EHR product as reported in the Certified Health Information Technology Product List.

3) Data provided by the Office of the National Coordinator for Health Information Technology

______________________________________________________

These different rankings of market share by EHR vendors show that a handful of companies dominate in both the hospital sector and the ambulatory sector. But there is more to this story. Software Advice says that, “…the number of EHR products on the market continues to proliferate. In 2012, there were 437 unique vendors with MU attestations (including those in the inpatient or hospital settings). By 2013, that figure jumped to 556—an increase of over 25%.”

When Physicians Switch Their EHR, Labs Must Write New Interface

Assuming those numbers are accurate, it means that medical labs and pathology groups will continue to field requests from office-based physicians to develop interfaces for some number of these 556 different EHR systems. Since each interface requires customization to effectively enable electronic lab test ordering and lab resulting, it means labs will be spending substantial dollars on interface activity for several more years into the future.

—By Patricia Kirk

Related Information:

50 Things to Know About Epic, Cerner, MEDITECH, McKesson, athenahealth and Other Major EHR Vendors

EHR Meaningful Use Market Share: IndustryView, March 2014

Epic Defends Interoperability bona fides

EHR users unhappy, many switching

EHR Meaningful Use Market Share

Black Book names best of the best EHRs

Redirecting Innovation in U.S. Health Care: Options to Decrease Spending and Increase Value

VistA and Epic: A tale of two Systems